Quick Contact

Molinari Oswald LLC

4508 Old Bethlehem Pike

Center Valley, PA 18034

p: 610-871-6700

f: 610-871-6777

Hours: Monday – Friday 8:30am – 5:00pm

Portal/Safesend/Teams Resources

We are excited about our secure Client Portal and you should be too. It is a state of the art, secure communication platform. It will allow us to share documents and give you anytime access to all your important records.

Safesend is our method of securely delivering your tax returns. It also facilitates the review and completion of all tax filings with a user friendly process. This can be done on any device.

See below for help videos and links to FAQ pages.

QOUNT Client Portal [NEW!!]

Portal: access to multiple accounts with one login

It is possible to access multiple portal accounts with one login. If you need access, please request via email to your contact in the firm.

The accounts you have access to will be listed on the left menu bar under Messages section:

You also have access to documents for the same clients under #Documents.

Organizer: accessing and printing

To access your organizer log in to your Qount portal account or click on the secure link in the email notification. If accessing from email you are taken directly to the organizer. If accessing in the portal see below.

Select questionnaire. This is access to both your organizer and your questionnaire.

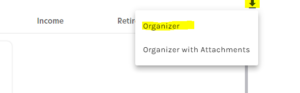

Select your name. Follow the prompts to complete the organizer online. You can stop and start the process and your information will be saved up to date. When complete, select submit. We will be notified the organizer is complete. This information will remain in your portal account for your future access. If you want to save or print a copy, select the arrow as shown below and select organizer. Once downloaded you can print a copy.

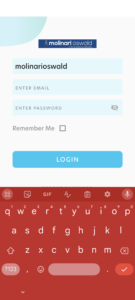

Qount Client Portal mobile app

Search for Qount Client Portal in the app store. Install on your mobile device. You must have already activated your account via the activation email prior to installing this on your mobile device. Once installed, open the app and login. See screen shot below:

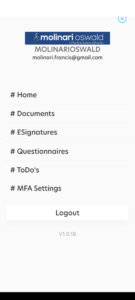

A few more screen shots for familiarity:

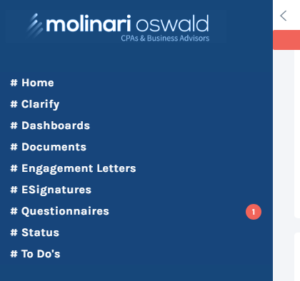

Qount client portal main menu

#Home

This page helps user(s) understand what each section refers to in the portal.

#Clarify

This function is currently not in use.

#Dashboards

This view is a summary of all messages and documents.

#Documents

This view is all folders and documents accessible to you. Note you can only upload to the client upload folder.

#ESignature

This function is currently not in use.

#Invoices

This view is all your invoices open and paid.

#Questionnaires

This view are all questionnaires provided by us for you to complete.

#Status

This view will provide the status of various projects we are working on for you.

#ToDo’s

This function is currently not in use.

#Messages

This view contains all communication between you and the firm sent through the portal.

#Dashboards Qount client portal

On the left side is the main menu.

Unread Posts: User(s) will be notified by the recent posts in this section.

Recent documents: When firms upload any documents, user(s) will receive notifications in this section.

ToDo’s: This feature is currently not in use.

#Documents Qount client portal

In case of multiple entity(s) mapped to the same user, the user will be displayed with multiple folders with entity name as folder.

Click on the required folder i.e entity and user will be displayed with all the folder(s) / document(s) that he/she has access to.

Note: documents can only be uploaded to the Client Uploads folder.

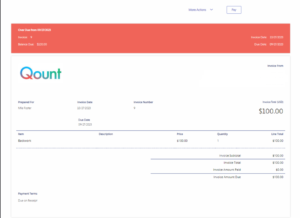

#Invoices Qount client portal

User(s) can view the Open and Paid invoices here.

User(s) can view details of Invoice(s) such as Invoice date, Due Date and Invoice Amount and Due Amount and option to make payment.

When Pay is selected, the User is directed to an image of the invoice to view.

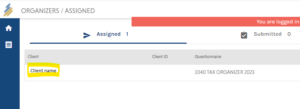

#Questionnaires Qount client portal

User(s) will be displayed with the Questionnaire Dashboard and Questionnaires are categorized based on the status.

Assigned: User needs to click on the Questionnaire and submit all the required information.

Submitted: Questionnaires that were submitted can be seen in this section.

Locked: Once a user submits, firms will mark the Questionnaires as locked to review the same. When Questionnaires are in this status, the user cannot edit the responses.

Done: Once review is completed by the firm, firms will mark as completed and Questionnaires will move to Done status.

#Status Qount client portal

![]()

This section helps the user(s) understand the current status of the service/work that firm is providing and its current status.

#Messages Qount client portal

Documents: The folder icon on the right menu, on click of its user will be redirected to the Documents page.

Vault: User(s) can store the sensitive information like id’s passwords and relevant details like site url, corresponding security questions.

Billing: This page is a condensed view of all the information from billing details to the Invoices.

Integrations: This feature is currently not in use.

SAFESEND

More FAQs

What are the benefits to you, the client?

- You will be able to electronically view, sign, save and print your tax documents.

- You will have access to your tax return for seven years.

- You will be able to receive estimated tax payment reminders at a schedule of your choosing.

- You can securely forward your tax documents to anyone you choose, such as a bank.

How will it work?

Once your return has been completed, you can expect an e-mail from Molinari Oswald LLC at noreply@safesendreturns.com. Check your Spam or Junk folder if you do not see it.

Will it work with any internet browser?

For the best experience, we recommend using Google Chrome. It will also work with Safari, Firefox, as well as other browsers, but we strongly discourage using Internet Explorer while using SafeSend. SafeSend does not work well with Internet Explorer.

How will I securely access the software?

Once you click on the link in your e-mail from SafeSend, you will be required to enter the last four digits of your Social Security Number. You will then request an Access Code, which will be e-mailed to you by SafeSend. Copy and paste the Access Code on the next screen within 20 minutes.

What if I can’t remember the Access Code or it expires?

You can click on any link in any e-mail from SafeSend Returns and you will be re-sent the link for a new Access Code by noreply@safesendreturns.com. It doesn’t matter how old the e-mail is.

Can I review the tax return before signing it?

You will be able to view any portion of your tax return prior to signing.

How will I verify or confirm my identity to be able to sign my personal tax return?

You will be required to answer knowledge-based authentication questions before being allowed to sign. This is an IRS requirement. If you are unable to answer the questions after three attempts, you will be given the opportunity to print your e-file forms and securely upload them to Molinari Oswald LLC after signing.

How will my spouse and I sign a joint return?

One taxpayer at a time will go through the signing process. After the first taxpayer signs, the 2nd will receive an e-mail from SafeSend to sign the returns.

I received a message saying that I couldn’t electronically sign my return and that I need to download the paper e-file forms. Why?

If an individual has not established a significant history in the U.S., perhaps because they are younger than 18 years of age or live outside the U.S., there will not be enough government and financial information available to construct knowledge-based authentication questions.

Will I get reminders about signing the e-file forms?

You will receive regular reminders about signing, about every seven days and possibly more often as the deadline approaches.

Part of my tax return must be printed and mailed to the taxing authority – it can’t be e-filed. How will I print it?

Any paper returns will be included as Attachments. You will receive clear instructions on how to access and download these or other items that must be mailed. If you are unable to print your Attachments, please reach out to the “Contact Person” listed in the red bar at the top of the page for assistance.

Do I have to finish the review and signing process in one sitting?

No. You can put your return aside and come back to it at any time.

Will I get reminders about estimated payments?

During the process, you will be given the opportunity to set a reminder schedule for estimated payments. Choose the timing that works best for you.

Will I have the option to download and print my return?

Yes, you will have the opportunity to do so after you’ve signed your returns. You will always be able to download and print your returns at any time.

What is Signer Delegation?

Signer Delegation allows someone other than the signer to review a tax return, then delegate signature to the person authorized to sign the e-file authorization forms. This is most commonly used with business returns where a CFO or Controller reviews a return but the signer is a different person, such as the CEO.

Can I send K-1s to recipients through SafeSend?

After you sign the return, you will be given the opportunity to either securely e-mail the recipients directly once you’ve edited their details, or you can download and print the K-1s to mail yourself.

What about my source documents?

If you sent us a hard copy of your source documents, the original documents will be mailed back to you.

Can I send my tax return to my bank?

You are given the opportunity to forward your return or portions of it to anyone you choose. To prevent the result of errors in e-mail addresses, the recipient will need to verify their identity.

If I need a copy of my return in a couple of years, how can I access it?

Your tax return will be available through SafeSend for seven years. You can click on any link in any e-mail from SafeSend Returns. It doesn’t matter how old the e-mail is. You will receive a link with an Access Code from noreply@safesendreturns.com. You can proceed to download an electronic copy of your return.

What if I need help navigating through the software?

Just reach out to your Molinari Oswald LLC by phone or e-mail. The “Contact Person” link in the red bar at the top of the page will contain this information.

Is my information secure?

Client data is encrypted by SafeSend and stored on secure servers managed by their parent company, cPaperless. Data access is restricted to authorized accounts. Decryption is inaccessible by unauthorized accounts. If you would like further information, please let us know.

Is there a SafeSend App?

There is no SafeSend app yet, but we’re told that one is in progress.

Do you still have questions?

The link to your contact’s name is in the red bar at the top of the page.